Even the rich and famous have trouble keeping their finances hassle-free, even though most might think that they have figured out exactly what works in business and their own financial life.

But you’d be very wrong. Billionaires make money mistakes all the time and even admit to doing so. Some even claim their errors were learning points for them, helping them become better at money management.

However, the majority of them commit financial blunders which would be points of reference for when we come into big bucks.

Here are some money mishaps of the rich and famous we can learn from!

6 Money Mishaps of the Rich and Famous You Can Learn From

1. Not paying taxes.

Several rich and famous people have tried to circumvent paying their taxes only to get burned by Uncle Sam who always collects.

Wesley Snipes, Ja Rule, Martha Stewart, and Nicholas Cage are some of the celebrities that owed their taxes. When you owe taxes, you incur penalties and interests which means more money is taken out of your pocket.

Let’s also not forget the emotional and mental stress that you could undergo when the IRS comes calling.

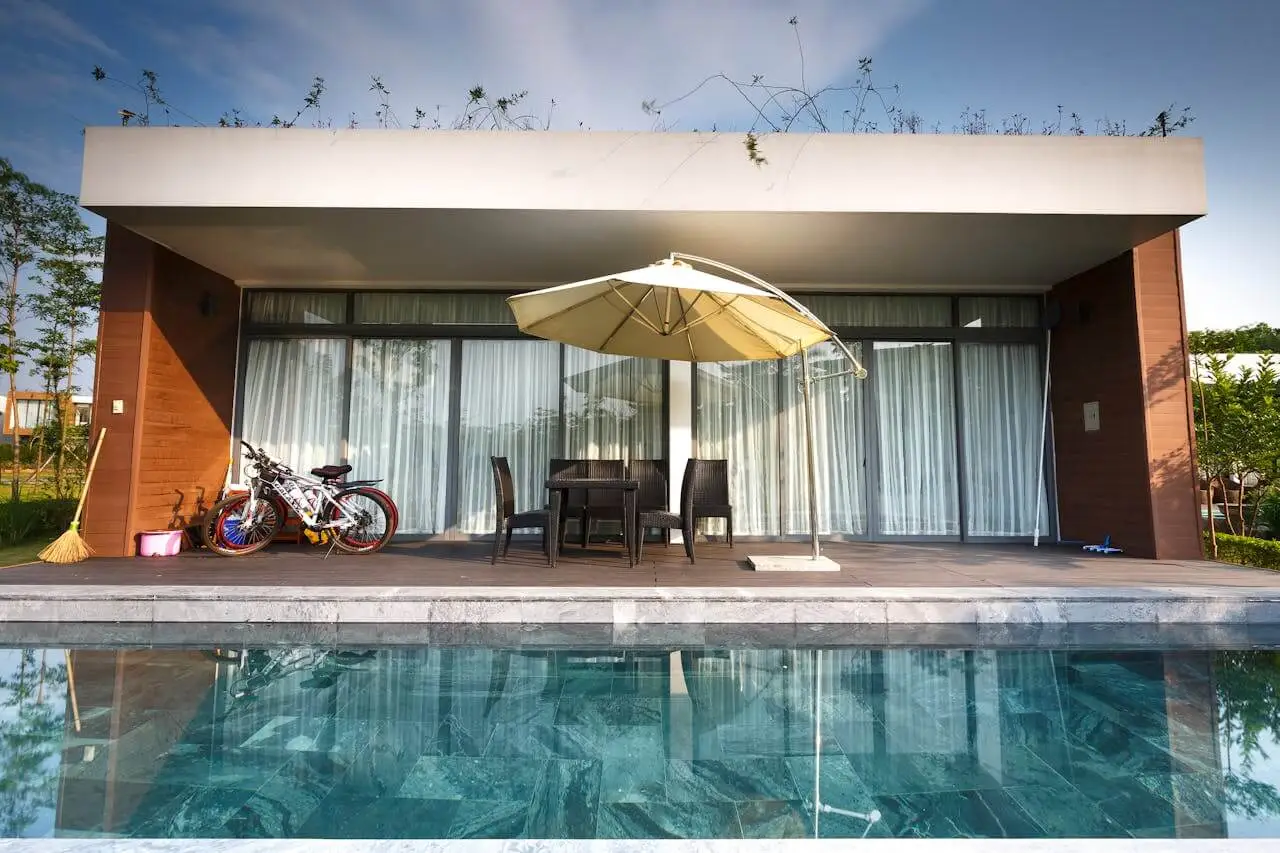

2. Living extravagantly.

The rich and famous are known for living extravagant lifestyles…well, most of them.

The limits of celebrity conspicuous consumption continue to be pushed. Some of the rich and famous have distinguished themselves by the sheer quantities of cash spent on quirky luxury items.

- Mike Tyson in his heyday bought two Bengal Tigers and splurged $2m on a gold bathroom.

- Rihanna is rumored to have spent $1m on hair treatment.

- Dennis Kozlowski, former CEO of the Tyco International manufacturing company reportedly spent $2m to organize his wife’s 40th birthday.

Yet it’s not only the rich and famous that live extravagantly.

Ordinary people also engaged in this lifestyle, sometimes in emulation of the celebrities whom they see as idols. But wealth cannot be built by engaging in frivolous spending. Money has to be put to work to generate more money.

While it’s good to treat yourself to the finer things of life, like every other thing, this should be done in moderation. When you have money, the question that should guide your actions is “how best can I put this money to good use?”

Like Charlie Munger says: “Money invested saves you a day from work.”

3. Failed investments.

A lot of celebrities have made bad investment decisions that would make you cringe.

This is not surprising considering that many celebrities come from fairly humble beginnings with no more finance training than the average public school kid. This in turn affected their investment decisions when they came into money more than they ever dreamed of.

MC Hammer bought a mansion and spent $500,000 a month paying servants to attend to his home, treating his entourage to a lavish party lifestyle.

Model turned actress Kim Basinger purchased the town (Bank of Braselton, Georgia) for $20 million. Her idea was to turn the town into a tourist destination with its film studios and movie festival. However, she sold the property for $1m five years later after she could not bring the project to reality.

While no one is immune to failed investments or making bad business decisions, even the Oracle of Omaha made a $200bn mistake.

However, it underscores the need for due diligence and risk management. When faced with an investment decision, do not go all in. Weigh your risks appropriately and invest only what you can afford to lose.

If you are unsure, you can spread your investment over time and see how it pans out. This allows you to study the investment while risking less capital.

4. Poor investment advice.

You’d think that the rich and famous with all the money and connections at their disposal would be privy to the best financial advisors.

However, history shows us that they can be victims of bad financial advice from these so-called professionals.

Rihanna fired her accountants in 2010 after the Barbadian singer was left ‘effectively bankrupt’ at the end of 2009 due to bad financial advice which saw her lose $9m in one year. Her accountant advised her to buy a Beverly Hills mansion for 7.5m, which turned out to be moldy and leaking.

In 2010, Nicholas Cage sued former business manager Samuel J. Levin and his firm for $20 million, saying they gave him bad financial advice and mismanaged his money. Former NFL star Terrell Owens’ financial advisor put his money into bad investments, including a casino that went bust.

While you may depend on experts on the best ways to use your money, the financial misfortune that befell some of these celebrities shows that all investment advice is not good advice.

This is where self-education comes into play. Rather than depending on others, take the pain to educate yourself. This way you can consult due diligence on investment options.

Besides, it costs less to educate yourself on money management than to depend on others.

5. Not negotiating enough.

Some celebrities failed to negotiate their true worth and got underpaid for it.

For example, Jennifer Lawrence (star of The Hunger Games series) disclosed that she was paid less for the movie “American Hustle” than her male co-stars, Bradley Cooper, Christian Bale, and Jeremy Renner.

Lawrence initially did not know about the wage gap between her and her male co-stars until the Sony hack of 2014, which leaked confidential emails.

This shows that you should never underestimate your value, and always negotiate what you deem is your worth. If it can happen to stars, then most probably it can happen to you.

6. Instant gratification.

The celebrity lifestyle is all about showmanship.

This means they do things to get validation from the public. One area where this is noticeable is their quest for instant gratification. Splurging on liabilities like cars, jewelry, clothes, or even real estate they can’t manage to send them down the rabbit hole of fiscal irresponsibility.

Some famous people also forget that you can only hold the public’s attention for so long. There will come a time your fame will wither away, and public attention will be diverted to the next biggest star.

Rather than splurging on liabilities, why not invest your money in assets to create generational wealth? Just like celebrities whose fame may wither at some point, opportunities to create and multiply wealth may be few and far coming.

The only way to ensure that you constantly create income is how you use the resources presently available to you.

Always have a plan to maximize your cash before it even hits your account.

7. Not saying ‘no’.

All the worms of your past life seem to crawl out of the woodwork when you get rich and famous.

Some celebrities, because of their humble beginnings, feel the need to help out family members and friends who are in financial trouble. While this is a commendable act, it has also led some of them to financial ruin.

MC Hammer famously reported having a staff of 200 with a monthly payroll of $500,000 for friends and family who did nothing for the money. Former NFL star Terrell Owens also reportedly doled out a lot of cash to help friends and family.

On a much smaller scale, this can happen to everyday people as well. You may find yourself in situations paying for family members’ bills, for example. Although small amounts at first, they can add up quickly and put you in a bad financial situation.

Apple founder Steve Jobs defined focus as learning to say no to too many good ideas. The same goes for financial discipline. There are many ways you can empathize and support loved ones other than becoming a human ATM.

When approached for money, draw up a loan agreement and agree on repayment plans.

Also, ask them about their financial plans and what they intend to use the money for. This will give you insight into if the person will use the money for a worthwhile venture or if they just want to take their share of your bounty.

4 Ways You Can Set Clear Financial Boundaries with Friends & Family→

The Takeaway

Stories of rich and famous people going bust are a clear indication that without financial education and sound money management skills, it would be impossible to keep your money, let alone grow it.

While too many people prioritize chasing riches, more important is knowing when and how to invest them. This is why people who earn less but have sound financial knowledge can grow their wealth through diligent investment.