When stocks are on the rise after a period of decline, the natural impulse can be to hit the “buy” button.

However, you may be buying into a suckers rally after which the stock will continue to plummet, leaving you with more losses than you imagined.

Panic buying can significantly lower returns if you rush into the market in hopes of riding the bull next wave.

Experienced investors know that the rise in a stock could be something known as a dead cat bounce. Knowing how to spot one could save you in losses.

But how can you spot one?

In this article, we take a look at this chart pattern, what signs to look out for and how to trade one even if the market is in a decline.

What is a Dead Cat Bounce?

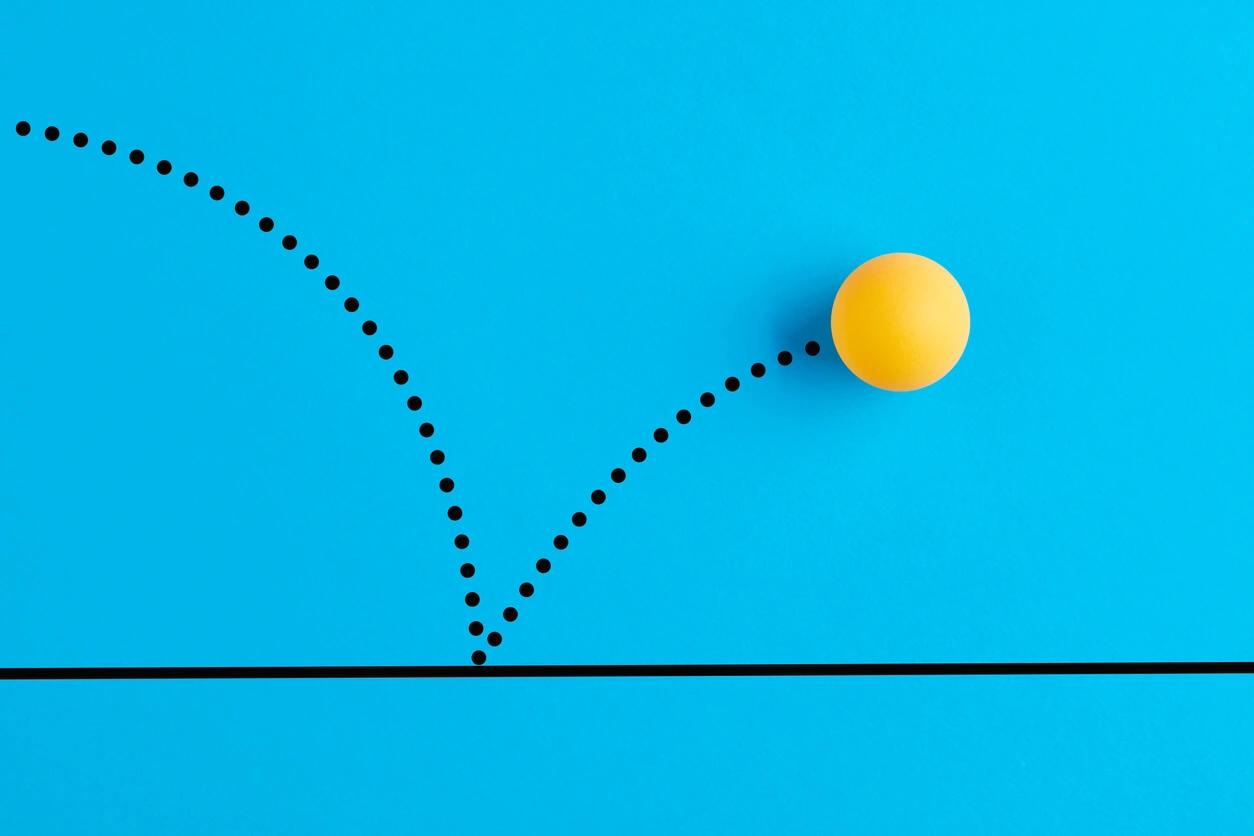

The somewhat graphic phrase comes from the idea that even a dead cat would bounce if dropped from a significant height. It is used to describe a seeming change in the price action of a security.

In finance, a dead cat bounce is a small, brief recovery in the price of a declining stock. Derived from the idea that “even a dead cat will bounce if it falls from a great height.” – Wikipedia

It refers to a situation when a security experiences a temporary recovery from a prolonged decline. This reversal in price action makes traders and investors believe that the security has bottomed and is rebounding, only for it to continue to decline afterwards.

What Causes a Dead Cat to Bounce?

There are some reasons why this occurs in the stock market.

For example, if there is some positive news about the stock or company like:

- a change of management

- or a release of new product or earnings report

This could renew investor interest in the stock.

Another could be that short sellers are closing out their position after a period of decline. Because they need to buy the stock back to close their position, this would send the price of the stock higher, thus leading traders to believe that the stock is rebounding.

A dead cat bounce can also happen as a result of technical reasons, such as the stock reaching key support levels, or technical indicators indicating that the stock has been oversold.

This could make traders take position in the stock.

If the stock is a penny stock, it could be that some mischievous traders are trying to initiate a pump-and-dump scheme.

Characteristics of a Dead Cat Bounce

Identifying one is difficult, but there are several indicators you can look out for.

Short-Lived Rally

Rallies of a dead cat bounce do not last.

This is because there is no sustained buying interest due to the reasons mentioned earlier. As such, the spike in price action fizzles out just as fast as it started. Sometimes, a rally may last for days or even weeks, making investors believe that there is a recovery before losing momentum.

Low Trading Volume

During a dead cat bounce, rallies don’t last long because there aren’t enough people buying.

The buyers who caused the price to go up can’t keep up the trend, so the price goes down even more. Traders may have stopped buying because the sudden rise in price gave them a chance to cut their losses and get out of their positions.

Choppy price movement

If price movements are choppy, this could be an indication of a dead cat bounce.

A choppy price movement shows as a price gap in the candlestick chart. A price gap occurs when the price of a security opens well above or below the previous close with no trading activity in between.

A Lower High

Dead cat bounces are characterized by lower highs.

In technical analysis, a lower high means that the closing price of a security within a period (15 mins, 1 hour, 1 day) is lower than the close of the preceding one. The lower price closes indicates that buying volume is getting low and selling is increasing.

Can you spot a dead cat bounce?

Spotting a dead cat bounce is very difficult.

This is because they can only be identified after they have occurred. The price reversals and chart trends like low buying volume, short-live trades or lower-highs only become obvious after it has occurred.

What makes it more difficult is that this ‘reversal’ could go on for days or weeks, making it more difficult to predict.

An example of this happened in February 2020, when U.S. indexes lost about 12% in a week. This drop was followed by a 2% rally the following week, only for the market to plummet further down until the stock market recovered in June. This is why dead cat bounces are also known as ‘a sucker’s rally’.

Final Thoughts

It can be too hard for most investors to distinguish between a dead cat bounce and a legitimate rally.

It is not possible to know about a dead cat bounce until after it has occurred. This is why financial experts advise against timing market. Taking action is a best way to approach a trade. It is usually better to hinge your decisions on fundamental reasons.