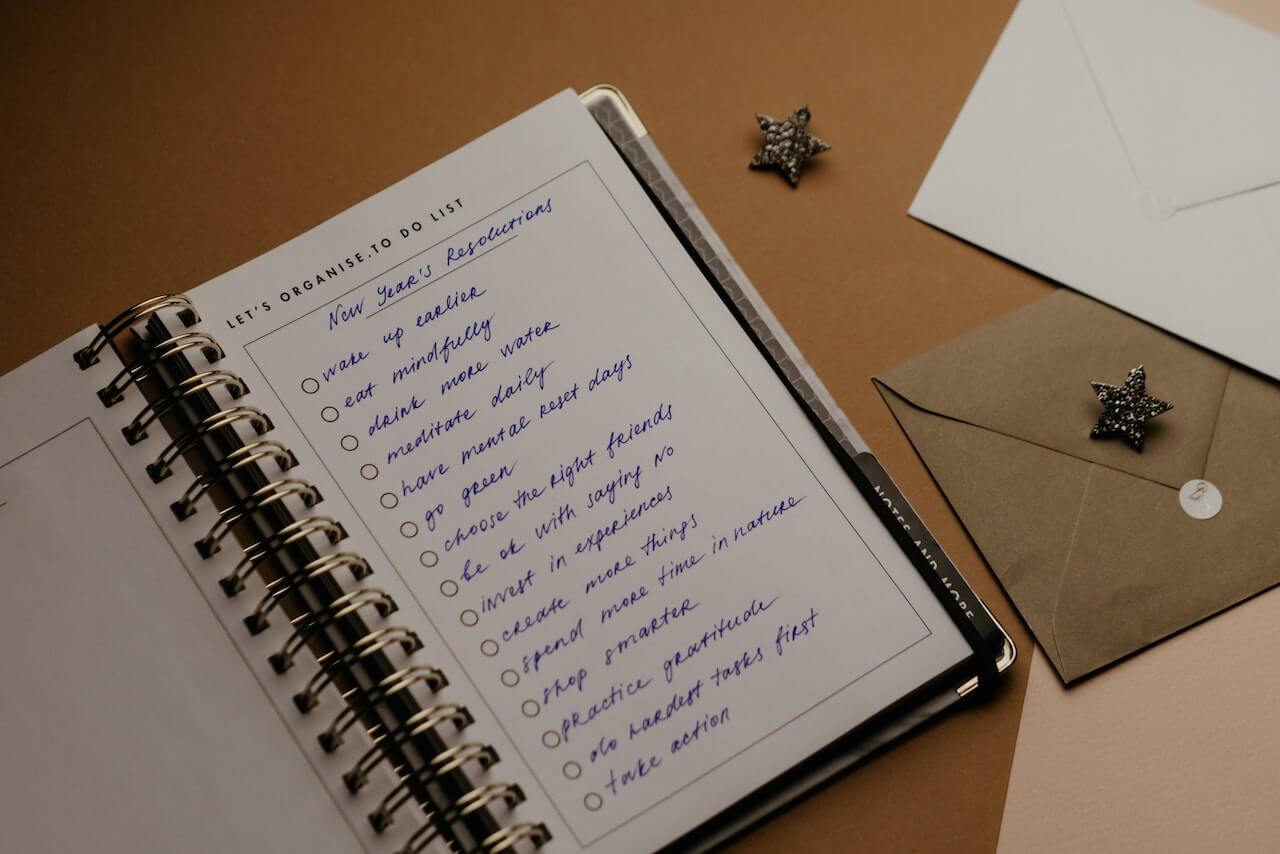

As the holiday season is upon us and the year is coming to an end, this is a great time of year to reflect on your year and start planning and setting financial goals for the new year ahead.

Taking the time to look at how your year was can help you plan for next year, giving you ideas on what you want to focus on.

Reflecting on 2022

If you set goals for yourself this year from focusing on your health or finances, it’s important to look back on the year and evaluate how you did on these goals.

If you don’t have official goals, you can still look at the things you accomplished and reflect on them.

1. List major accomplishments.

Take a piece of paper or open up a Word document and write down everything you accomplished for this year.

Nothing is off-limits. Anything you are proud of can be on this list.

For example:

- Did you set a goal to save for your Roth IRA, or did you fully fund your emergency fund?

- Did you get a raise or accept a new job with a salary increase?

- Did you take the time to learn a new skill?

Listing out all of the things you did this year can help you realize how much you accomplished. It can be so easy to see a year as a failure because you didn’t reach all of your goals.

But even reaching some of your goals and things that you didn’t plan out can help you have a more positive look on the new year.

2. Write about how you accomplished these goals.

After you’ve listed each goal, write about how you accomplished these accomplishments and even any struggles you’ve faced.

Saving for an emergency fund is a hard thing to do!

- When you started off, how did you feel?

- Throughout the year, as you were saving, did you ever doubt you’d be able to do this?

- When you accomplished this, how did you feel knowing you completed this huge goal?

This is the reflection part of your year.

Going back and writing about every emotion and stage can help you feel more proud of the hard work you did and the sacrifices you made. For example, you may have missed out on dinners with friends and social events, and while you were working on your goal, you may have felt upset about missing out.

However, when you reached this goal, did those worries and fears go away, or do you think you could have taken a better approach?

Be honest with yourself during this reflection.

3. Write about what you didn’t accomplish.

If you had goals that you wanted to reach, write down and reflect on these as well.

It’s important to understand why you didn’t reach your goal.

- Was it too big of a goal?

- Was it not really a focus for you during the year?

- Did you accomplish half of your goal but not fully get there?

This reflection can help you plan your goals for the following year.

For example, if you had a goal to save money and you didn’t accomplish it, it’s probably because the goal was too vague and not clear enough. Saving money is part of your goal, not the full one.

- Why do you want to save money?

- Where will you save it?

- How much will you save a month?

Setting Financial Goals for 2023

Once you’ve had time to reflect on your 2022 accomplishments and what you didn’t accomplish, it’s time for setting financial goals for 2023.

Look over what you did and didn’t accomplish and use that to develop new goals for the new year.

1. List areas of focus.

The best way to set a new goal is to start listing the areas you want to focus on and then develop SMART goals around that area. For example, most goals focus on health and finances, but you may also want to focus on your career, family, hobby, or starting a business.

2. Create SMART goals.

With your focus area list, you can now create SMART goals for each thing you want to accomplish in the year. A SMART goal will help you actually reach your goals. However, when a goal is too vague, it can be hard to know how to start.

S – Specific

Your goals should be specific. ‘Saving money’ is too vague of a goal.

For example, are you saving money for a vacation, for retirement, or to fund your emergency fund? Be specific about your actual goal, why you want to save for it, how much you will have to save, and how much a month you can save.

M – Measurable

Now that you have a specific goal, you need to find out how you will measure your goal.

For example, if your goal is financial, you should be able to create an account where you can measure this goal or use an excel spreadsheet to track how you are reaching this goal.

A – Attainable

We all set goals that might seem like we are reaching for the stars.

It’s good to have aspirations like this, but if you want to reach your goal, you have to ensure it’s attainable. For example, if your goal is to fill your emergency fund in a year, you need to run some numbers.

Are you able to save up the amount you need every month to reach this goal, or is this an unattainable number? If you don’t feel like it is attainable, adjust your goal. For example, maybe you need to save half of your emergency fund in the year so you can reach your goal.

R – Realistic/Relevant

Be realistic about your goal and make sure it is relevant.

For example, is your goal something you can actually reach, and is it something that aligns with your personal life? Of course, you want to be able to reach your goals and make sure they add value to your life, so make sure your goal fits your life goals.

T – Time-Bound

When setting a goal you want to reach, it’s important to set a time for when you want to complete it.

Some of your goals can be completed in a few months, while others will take a full year. It’s good to set a time for when you want to complete the goal to make sure you are staying on track.

Final Thoughts on Setting Financial Goals

The new year is an exciting time to set new goals and challenge yourself to better your financial situation.

It’s also a great time to reflect on all of the great things you’ve done and reflect on your year. Using this reflection time can help you gain insights into what went well and what didn’t go well in the year, as well as set new goals for the upcoming year.